World currency

In the foreign exchange market and international finance, a world currency or global currency refers to a currency in which the vast majority of international transactions take place and which serves as the world's primary reserve currency.

Contents

|

United States dollar and the euro

Since the mid-20th century, the de facto world currency has been the United States dollar. According to Robert Gilpin in Global Political Economy: Understanding the International Economic Order (2001): "Somewhere between 40 and 60 percent of international financial transactions are denominated in dollars. For decades the dollar has also been the world's principal reserve currency; in 1996, the dollar accounted for approximately two-thirds of the world's foreign exchange reserves" (255).

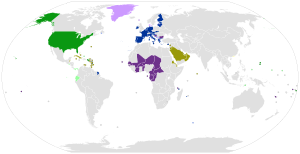

Many of the world's currencies are pegged against the dollar. Some countries, such as Ecuador, El Salvador, and Panama, have gone even further and eliminated their own currency in favor of the United States dollar.

Since 1999, the dollar's dominance has begun to be undermined by the euro, that represents a larger size economy, with the prospect of more countries adopting the euro as their national currency. The euro inherited the status of a major reserve currency from the German Mark (DM), and since then its contribution to official reserves has risen continually as banks seek to diversify their reserves and trade in the eurozone continues to expand.[1]

Similar to the dollar, quite a few of the world's currencies are pegged against the euro. They are usually Eastern European currencies like the Estonian kroon and the Bulgarian lev, plus several west African currencies like the Cape Verdean escudo and the CFA franc. Other European countries, while not being EU members, have adopted the euro due to currency unions with member states, or by unilaterally superseding their own currencies: Andorra, Kosovo, Monaco, Montenegro, San Marino, and the Vatican City.

As of December 2006, the euro surpassed the dollar in the combined value of cash in circulation. The value of euro notes in circulation has risen to more than €610 billion, equivalent to US$800 billion at the exchange rates at the time.[2] This results in the Euro being the currency with the highest combined value of cash in circulation in the world.

History

Spanish Dollar: 17th-19th centuries

In the 17th and 18th century, the use of silver Spanish dollars or "pieces of eight" spread from the Spanish territories in the Americas eastwards to Asia and westwards to Europe forming the first ever[citation needed] worldwide currency. Spain's political supremacy on the world stage, as well as the coin's quality and purity of silver, made it become internationally accepted for over two centuries. It was legal tender in Spain's Pacific territories of Philippines, Micronesia, Guam and the Caroline Islands and later in China and other Southeast Asian countries until the mid 19th century. In the Americas it was legal tender in all of South and Central America (except Brazil) as well as in the U.S. and Canada until the mid-19th century. In Europe the Spanish dollar was legal tender in the Iberian Peninsula, in most of Italy including: Milan, the Kingdom of Naples, Sicily and Sardinia, as well as in the Franche-Comté (France), and in the Spanish Netherlands. It was also used in other European states including the Austrian Hapsburg territories.

19th - 20th centuries

Prior to and during most of the 1800s international trade was denominated in terms of currencies that represented weights of gold. Most national currencies at the time were in essence merely different ways of measuring gold weights (much as the yard and the metre both measure length and are related by a constant conversion factor). Hence some assert that gold was the world's first global currency. The emerging collapse of the international gold standard around the time of World War I had significant implications for global trade.

In the period following the Bretton Woods Conference of 1944, exchange rates around the world were pegged against the United States dollar, which could be exchanged for a fixed amount of gold. This reinforced the dominance of the US dollar a global currency.

Since the collapse of the fixed exchange rate regime and the gold standard and the institution of floating exchange rates following the Smithsonian Agreement in 1971, currencies around the world have no longer been pegged against the United States dollar. However, as the United States remained the world's preeminent economic superpower, most international transactions continued to be conducted with the United States dollar, it has remained the de facto world currency.

Only two serious challengers to the status of the United States dollar as a world currency have arisen. During the 1980s, for a while, the Japanese yen became increasingly used as an international currency, but that usage diminished with the Japanese recession in the 1990s. More recently, the euro has competed with the United States dollar in usage in international finance.

Hypothetical single "true" global currency

An alternative definition of a world or global currency refers to a hypothetical single global currency, as the proposed Terra, produced and supported by a central bank which is used for all transactions around the world, regardless of the nationality of the entities (individuals, corporations, governments, or other organisations) involved in the transaction. No such official currency currently exists for a variety of reasons, political, economic, and cultural.

There are many different variations of the idea, including a possibility that it would be administered by a global central bank or that it would be on the gold standard [1]. Supporters often point to the euro as an example of a supranational currency successfully implemented by a union of nations with disparate languages, cultures, and economies. Alternatively, digital gold currency can be viewed as an example of how global currency can be implemented without achieving national government consensus.

A limited alternative would be a world reserve currency issued by the International Monetary Fund, as an evolution of the existing Special Drawing Rights and used as reserve assets by all national and regional central banks.

Arguments for a global currency

Some of the benefits cited by advocates of a global currency are that it would:

- Eliminate speculation in Forex since there is a need for a currency pair to speculate.

- Eliminate the direct and indirect transaction costs of trading from one currency to another [2].

- Eliminate the balance of payments/current account problems of all countries.

- Eliminate the risk of currency failure and currency risk.

- Eliminate the uncertainty of changes in value due to exchange-caused fluctuations in currency value and the costs of hedging to protect against such fluctuations.

- Cause an increase in the value of assets for those countries currently afflicted with significant country risk.

- Eliminate the misalignment of currencies.

- Utilize the seigniorage benefit and control of printing money for the operations of the global central bank and for public benefit.

- Eliminate the need for countries or monetary unions to maintain international reserves of other currencies.

Arguments against a single global currency

Some economists[attribution needed] argue that a single global currency is unworkable given the vastly different national political and economic systems in existence.

Loss of national monetary policy

With one currency, there can only be one interest rate. This results in rendering each present currency area unable to choose the interest rate which suits its economy best. If, for example, the European Union were to have an economic boom while the United States slumped into a depression, this period would be eased if each could choose the interest rate which best fitted its needs (in this case, a relatively high interest rate in the former, and a relatively low one in the latter).

Political difficulties

In the present world, nations are not yet able to work together closely enough to be able to produce and support a common currency. There has to be a high level of trust between different countries before a true world currency could be created. A world currency might even undermine national sovereignty of smaller states.

A currency needs an interest rate, while one of the largest religions in the world, Islam, is against the idea of interest rate. This might prove to be an unsolvable problem for a world currency, if religious views concerning interest do not moderate.

Having an interest rate is one of the fundamental laws of a market economy. Depositing of money is important because it lets the money be lent out where it is needed most, for instance when establishing a new company or buying a house for a family. In order to get strangers to lend each other money the creditors needs to get compensated for their risk taken and their good will. If not they would just spend the money, or keep it or invest it somewhere else. If you want to be without interest rate you need other ways to compensate depositors, and the compensation would have to be in the form of money, in other words an interest-look-alike.

Economical difficulties

Some economists argue that a single world currency is unnecessary, because the U.S. dollar already provides many of the benefits of a world currency while avoiding some of the costs [3].

If the world does not form an optimum currency area, then it would be economically inefficient for the world to share one currency.

A world currency would not allow for adjustments by national central banks to accommodate local economic problems. A single currency can only have a single interest rate. However, different regions in the world, with varying rates of economic growth, may require different interest rates.

As an example, consider a hypothetical Country A that is a petroleum exporter and a hypothetical Country B that is an oil importer. If the price of oil goes up, this is an advantage for Country A, and a disadvantage for Country B. If the oil price goes up, this stimulates the economy of Country A; to avoid "overheating" the economy, Country A's central bank would support increasing the interest rate of Country A. At the same time, Country B's economy is damaged by the increased price of oil, and Country B's central bank would seek to lower the interest rate in order to stimulate the economy. However, Country A and Country B would be unable to do this if they shared the same currency.

0 comments